|

|

|

|

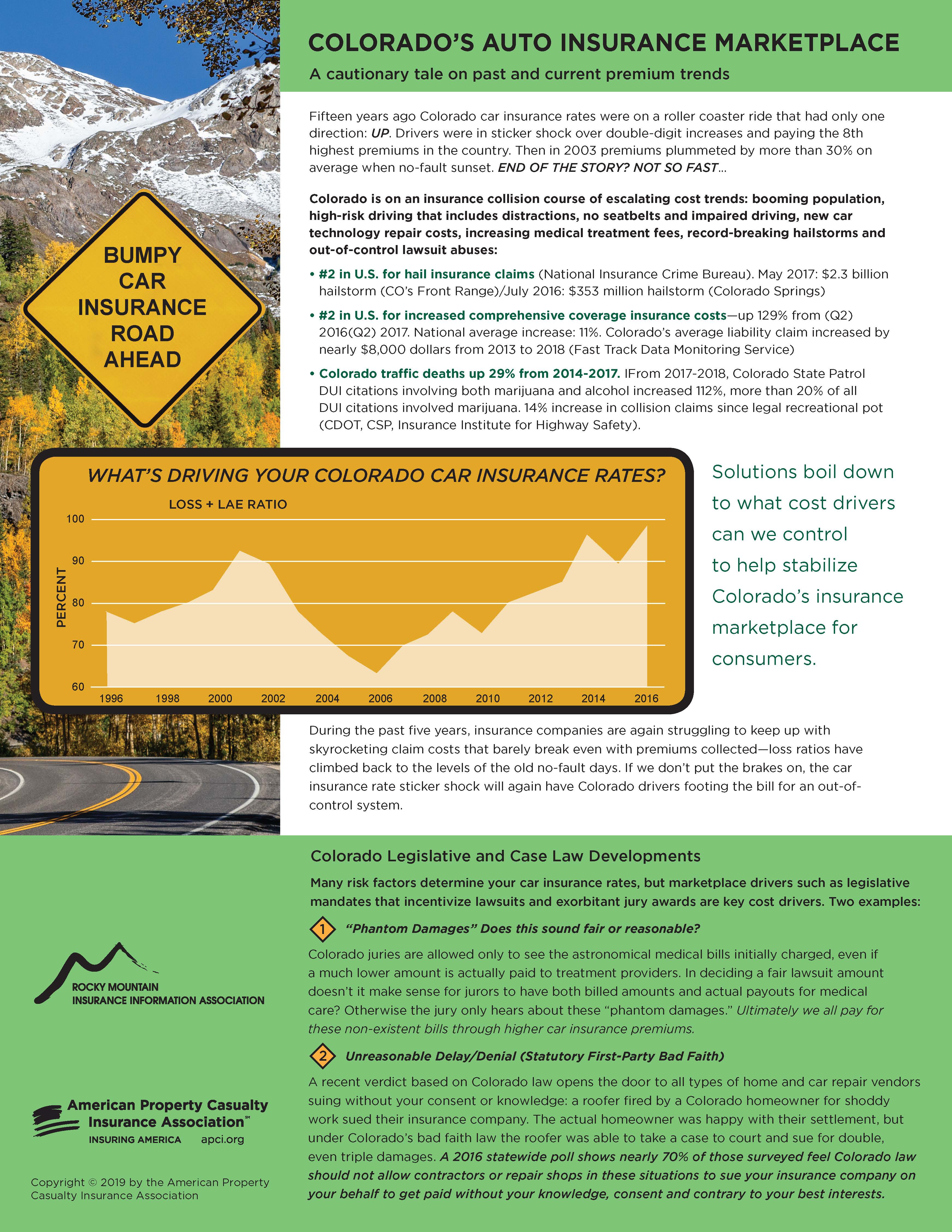

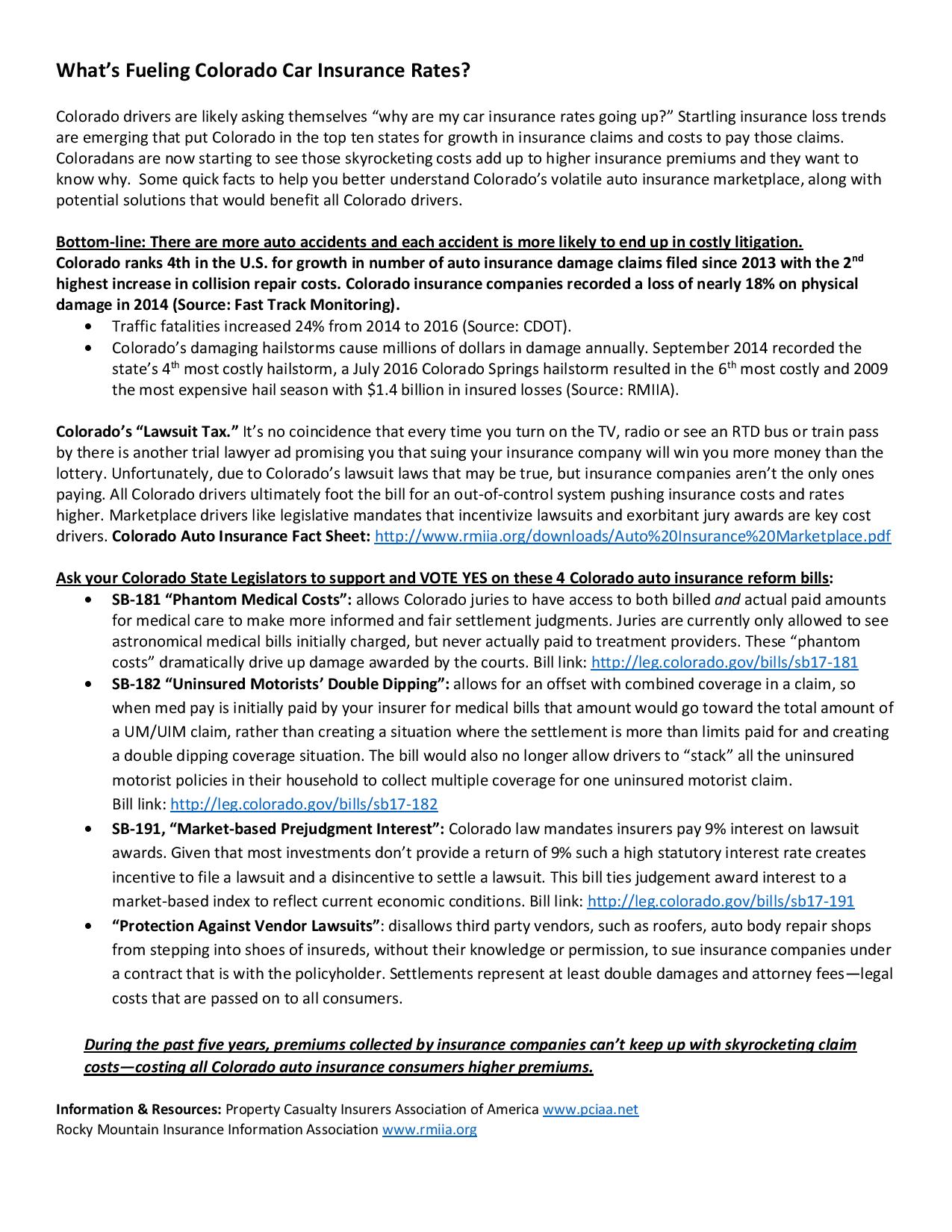

Colorado's Auto Insurance Marketplace & Fact Sheet A Cautionary Tale On Past and Current Premium Trends Fifteen years ago, Colorado Insurance rates were on a rollercoaster ride that had only one direction: UP. Drivers were in sticker shock over double-digit increases and paying the 8th highest premiums in the country. The runaway rate train? The state's costly no-fault auto insurance system. Colorado law required drivers to buy expensive mandated medical coverage, made wide-ranging alternative treatments commonplace and was a lawsuit "pot of gold". No-fault finally crashed in 2003 when public outcry pushed lawmakers to sunset the bloated mandates and return to fault-based auto insurance. Premiums plummeted by more than 30% on average and drivers could choose their insurance based on individual needs. Steady rate declines continued stabilizing Colorado's car insurance ranking and 27th. END OF STORY? NOT SO FAST...starting in 2008, legislation was pushed through to fill the lawsuit gap left by the end of no-fault. Lawsuits should result in fair verdicts and settlement amounts that hold guilty parties and insurance companies accountable - not lottery tickets that game the system and everyone pays for, through higher car insurance premiums. BUMPY CAR INSURANCE ROAD AHEAD - When no-fault sunset in 2003, insurers were paying $1.05 in claims for every $1.00 in premium, adding up to double-digit rate increases. Beginning in 2010, the loss trends reemerged, taking Colorado down the same path that ultimately leads to higher costs for consumers. During the past 5 years, insurance companies are again struggling to keep up with skyrocketing claim costs that barely break even with premiums collected - loss ratios have climbed back to the levels of the old no-fault days. If we don't put the brakes on, the car insurance rate sticker shock will again have Colorado drivers footing the bill for an out of control system. Colorado Legislative and Case Law Developments: Many risk factors determine your car insurance rates, but marketplace drivers such as legislative mandates that incentivize lawsuits and exorbitant jury awards are key cost drivers. Two Examples:

Download a printable PDF the Marketplace Flyer Download a printable PDF of the Colorado Fact Sheet At the other end of the spectrum, the poor 10-year results for Colorado (-1.2%), Louisiana (0.7%) and Georgia (0.6%) demonstrate real long-term problems. We always caution that problems with Michigan data can undermine the accuracy of the profit numbers, and since Michigan represents about 4% of national liablity premium, the impact of this data problem can be measureable, Because of the state's unique catastrophic claims system, incurred losses are misleading. The state is not nearly as troubled as our 10-year average would suggest. The data problems do not extend to physical damage. January 2020 - Auto Insurance Report

|

303-790-0216 • 800-355-9524 • Contact Us • Legal Notice, Disclaimer & Terms of Use

Home • About RMIIA • News Room • P&C Insurance Industry • Auto • Homeowners • Business • Catastrophes • Agent Resources • Events & Education • Brochures