|

|

|

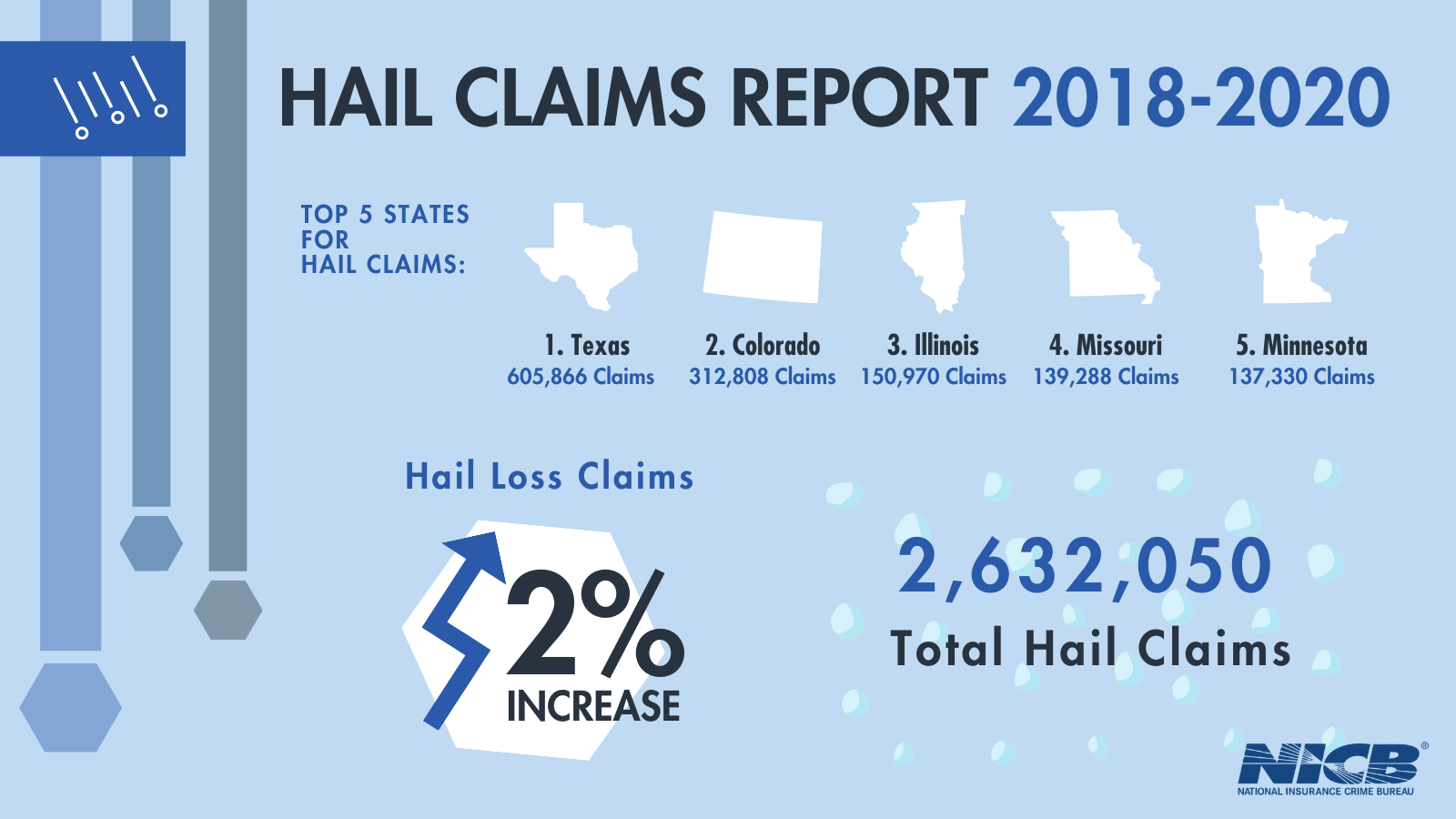

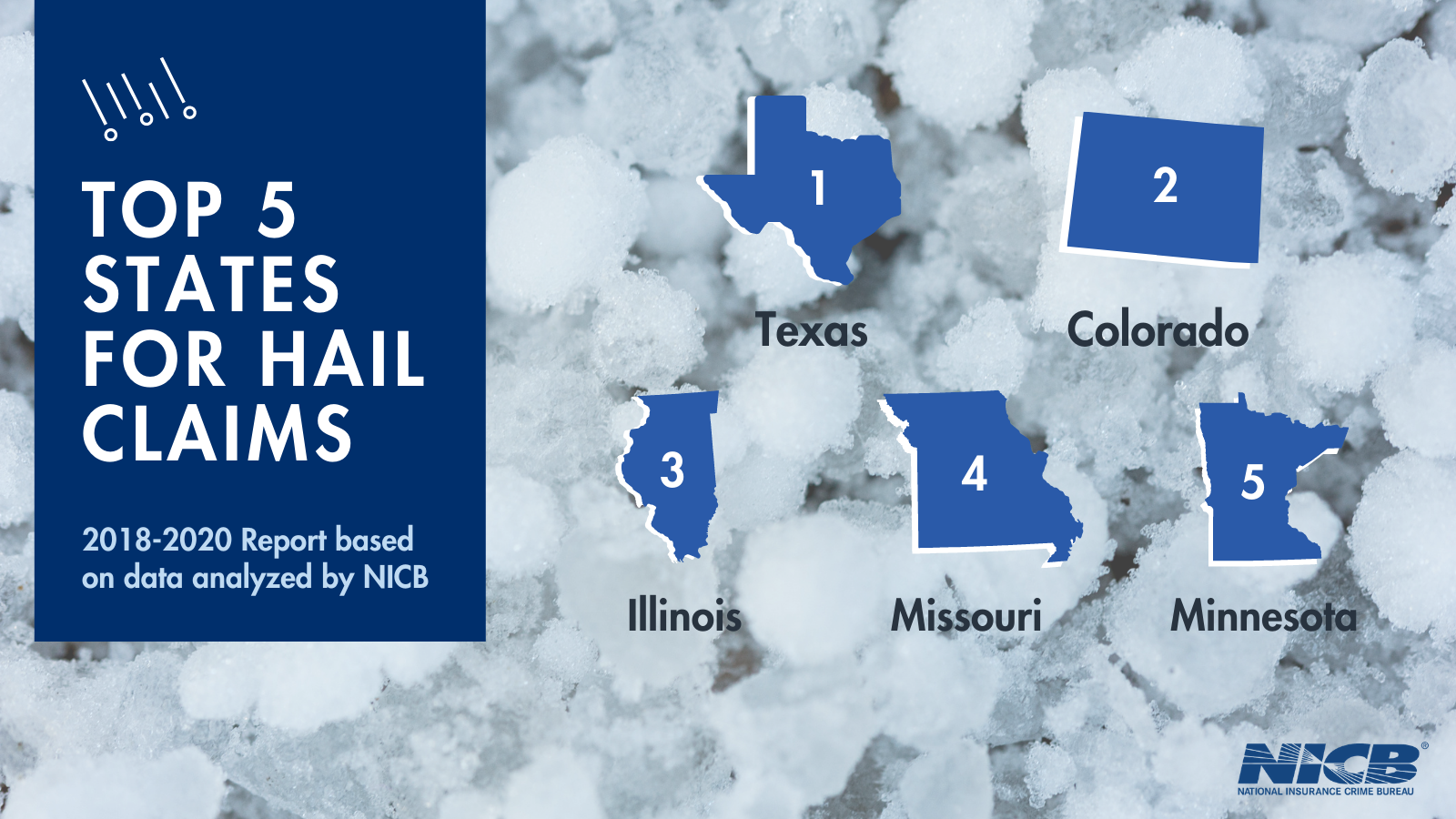

HailThe largest recorded hailstone in U.S. history fell on July 23, 2010, in Vivian, South Dakota, measuring 8 inches in diameter and weighing 1.94 pounds. The prized stone is now on ice at the National Center of Atmospheric Research in Boulder, Colorado. The previous record hailstone fell in Aurora, Nebraska, on June 22, 2003, and measured 7 inches in diameter and weighed 1.67 pounds (NOAA). IBHS released it’s new impact resistant shingle ratings IBHS Releases Its Most Expansive Impact-Resistant Shingle Ratings to Date – Insurance Institute for Business & Home Safety. National Hail Statistics According to a March 2021 NICB Hail Report, From 2018 through 2020, hail claims increased 2% from 832,377 to 849,033 and hail QC (questionable claims) submissions increased 34% from 1,462 to 1,958. From 2018 to 2020, hail claims tended to occur most often in the late spring to early summer months (April - June). Conversely, both hail claims and QC;s tended to occur the least often in the winter months (November - February) The nation has experienced severe storms (wind, tornado, hail) that are occurring with more intensity and affecting more areas of the country. While scientists debate why these storms occur, no one argues with their effects—extensive property damage and, many times, loss of life. The property damage can be as minimal as a few broken shingles to total destruction of buildings. There were 4,611 major hail storms in 2020, according to statistics culled from NOAA's Severe Storms database. In 2019, 5,382 major hailstorms occurred.

According to Verisk’s 2021 report, The Hail Hazard and Its Impact on Property Insurance, 6.2 million properties in the United States experienced one or more damaging hail events in 2020, about a million fewer than in 2019, reflecting the frequency fluctuations noted over the past 10 years. 2020 claims resulted in almost $14.2 billion in losses. Texas had the highest number of properties affected by hail, over 1.5 million properties, accounting for almost a quarter of total U.S. properties affected. Illinois followed with about a half-million properties affected, and Indiana ranked third with about 372,000 properties affected. Besides reiterating the spread of the hail peril into all states and the low frequency/high severity of hail occurring at irregular intervals, the report discusses the long tail aspect of hail losses due to the vulnerability of roofs to hail damage, which is often out of sight.Verisk Estimates. NOAA’s National Weather Service Storm Prediction Center Annual Severe Weather Report Summary reported 5,373 hail events in 2024 compared to 6,962 in 2023. Texas and Kansas had the largest number of hail events according to NOAA in 2024. Top 5 states for major hail events in 2024

*One inch diameter or larger. From III.org The United States experienced the largest insured loss event of 2014 - a spate of severe stoms with hail across five days in May struck from Colorado to Pennsylvania, causing insured losses of $2.9 billion.

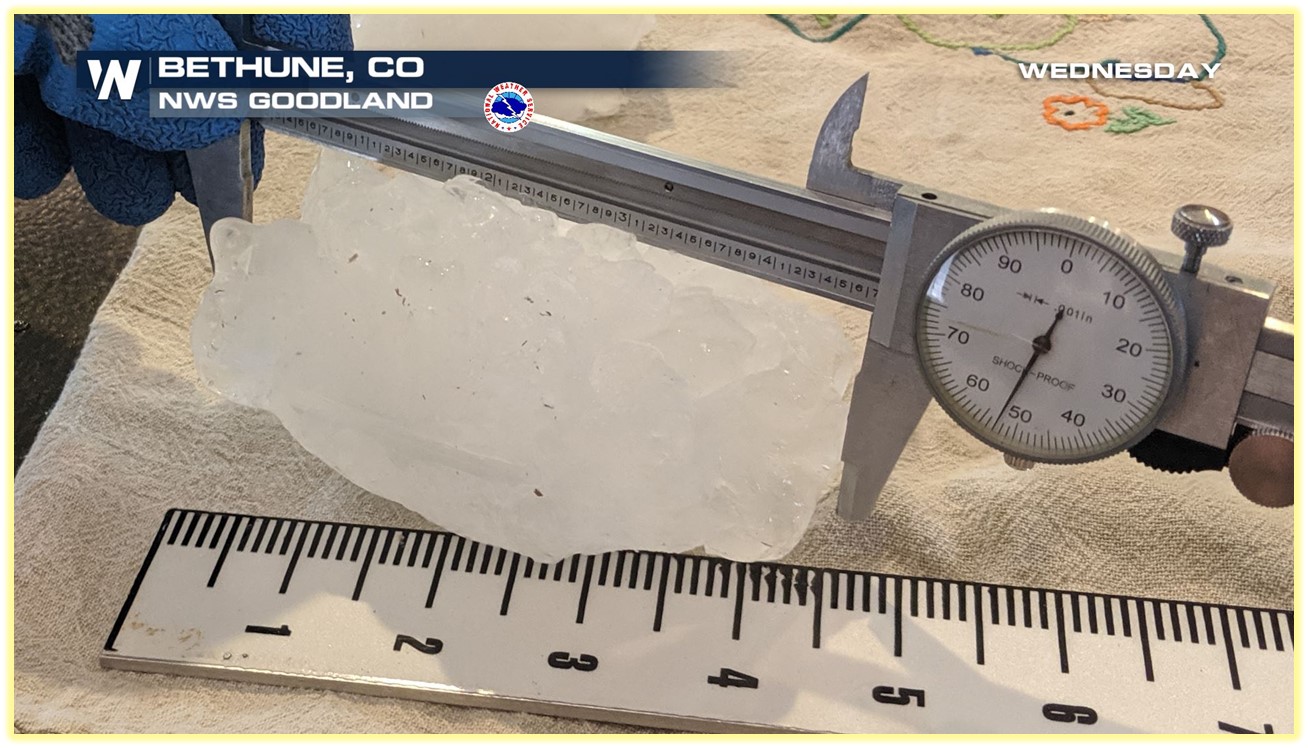

Colorado's damaging hail season is considered to be from mid-April to mid-September. Colorado's Front Range is located in the heart of "Hail Alley," which receives the highest frequency of large hail in North America and most of the world, so residents usually can count on three or four catastrophic (defined as at least $25 million in insured damage) hailstorms every year. In the last 10 years, hailstorms have caused more than $5 billion in insured damage in Colorado. As a result, up to one-half of your homeowners insurance premium may be going toward hail and wind damage costs. If you carry comprehensive coverage on your auto policy, hail damage is covered by almost all insurance companies. Comprehensive insurance is optional, but if you live in a hail prone area, the insurance industry recommends this coverage. It’s official: Colorado has a new largest hailstone on record Colorado’s Largest Hailstone 8/13: 4.85”, 8.5 Ounces

Colorado's Most Costly Hail Storms With the exception of the May 22, 2008, Windsor tornado and the hail storm that hit Pueblo on July 29, 2009, Colorado's ten most costly hail storms were centered in the Denver Metro area (which makes sense, because that's where the largest concentration of property in the state is located).

*2024 estimated cost calculations based on the Consumer Price Index. New Mexico Hail Statistics

Download RMIA's "Hail Damage Fraud" brochure. Assess the damage.

Protect your property from further damage.

File your claim

Select a repair company.

Use hail resistive roofing materials.

|

303-790-0216 • 800-355-9524 • Contact Us • Legal Notice, Disclaimer & Terms of Use

Home • About RMIIA • News Room • P&C Insurance Industry • Auto • Homeowners • Business • Catastrophes • Agent Resources • Events & Education • Brochures

First, if a hail storm strikes, don't go out in the storm to try to protect your

property. You could be injured.

First, if a hail storm strikes, don't go out in the storm to try to protect your

property. You could be injured.